Types of Futures trading Contracts: An Overview

Introduction

- Definition: Futures contracts are financial instruments that allow investors to speculate on the future price of an underlying asset or hedge against price risks.

- Variety: There are many different types of futures contracts, each with its unique features and characteristics.

Commodity Futures Contracts

- Definition: Commodity futures contracts are agreements to buy or sell a specific commodity at a predetermined price and date in the future.

- Examples: Some of the most popular commodity futures contracts include those for agricultural commodities such as wheat, corn, and soybeans, as well as energy commodities such as crude oil and natural gas.

- Benefits: Trading commodity futures can provide investors with exposure to the price movements of commodities, which can offer diversification benefits and potential profits.

Currency Futures Contracts

- Definition: Currency futures contracts are agreements to buy or sell a specific currency at a predetermined price and date in the future.

- Examples: Some of the most popular currency futures contracts include those for major currencies such as the US dollar, euro, and Japanese yen.

- Benefits: Trading currency futures can provide investors with exposure to the price movements of currencies, which can offer diversification benefits and potential profits.

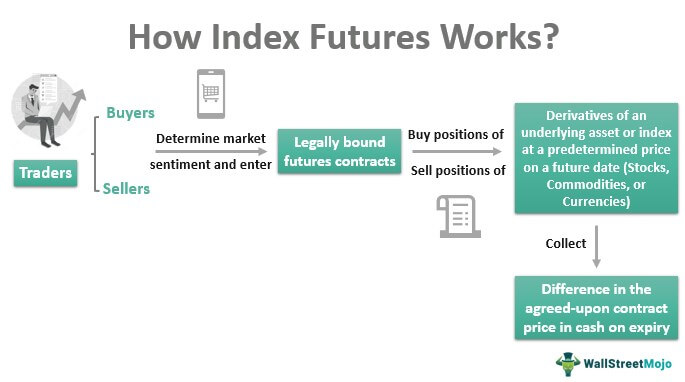

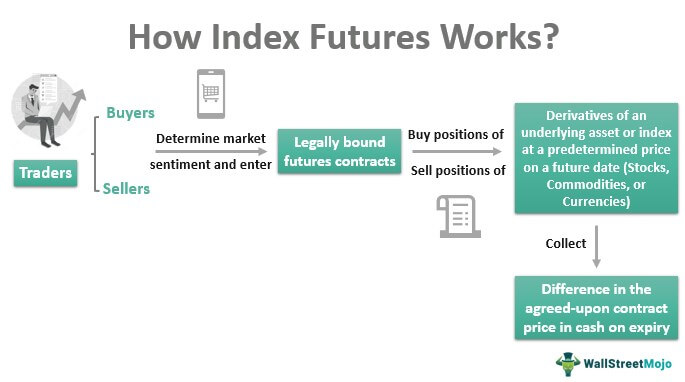

Stock Index Futures Contracts

- Definition: Stock index futures contracts are agreements to buy or sell a specific stock index at a predetermined price and date in the future.

- Examples: Some of the most popular stock index futures contracts include those for the S&P 500, Nasdaq 100, and the Dow Jones Industrial Average.

- Benefits: Trading stock index futures can provide investors with exposure to the price movements of broad stock market indices, which can offer diversification benefits and potential profits.

Financial Futures Contracts

- Definition: Financial futures contracts are agreements to buy or sell a specific financial instrument, such as a bond or an interest rate, at a predetermined price and date in the future.

- Examples: Some of the most popular financial futures contracts include those for Treasury bonds, interest rate futures, and currency futures.

- Benefits: Trading financial futures can provide investors with exposure to the price movements of financial instruments, which can offer diversification benefits and potential profits.

Choosing the Right Futures Contract

- Considerations: When choosing a futures contract to trade, it is important to consider factors such as the underlying asset, the size of the contract, the volatility of the market, and the level of risk tolerance.

- Guidance: It is recommended to work with a financial advisor or broker who can provide guidance and help you make informed decisions.

Conclusion

- Variety: There are many different types of futures contracts, each with its unique features and characteristics.

- Benefits: Trading futures can provide investors with exposure to the price movements of a wide range of assets, which can offer diversification benefits and potential profits.

- Importance of Education and Guidance: It is important to have a solid understanding of the markets and the underlying assets being traded, and to engage in effective risk management. It is also recommended to work with a financial advisor or broker who can provide guidance and help you make informed decisions.

GET MORE INFORMATIONS